Key Performance Indicators

A strong all-round performance

Financial highlights

`18,821 million

Distributions

99.8%

Payout ratio

Revenue from operations

(` in million)

- FY2019

- FY2020

EBITDA

(` in million)

- FY2019

- FY2020

Cash flow from operations

(` in million)

- FY2019

- FY2020

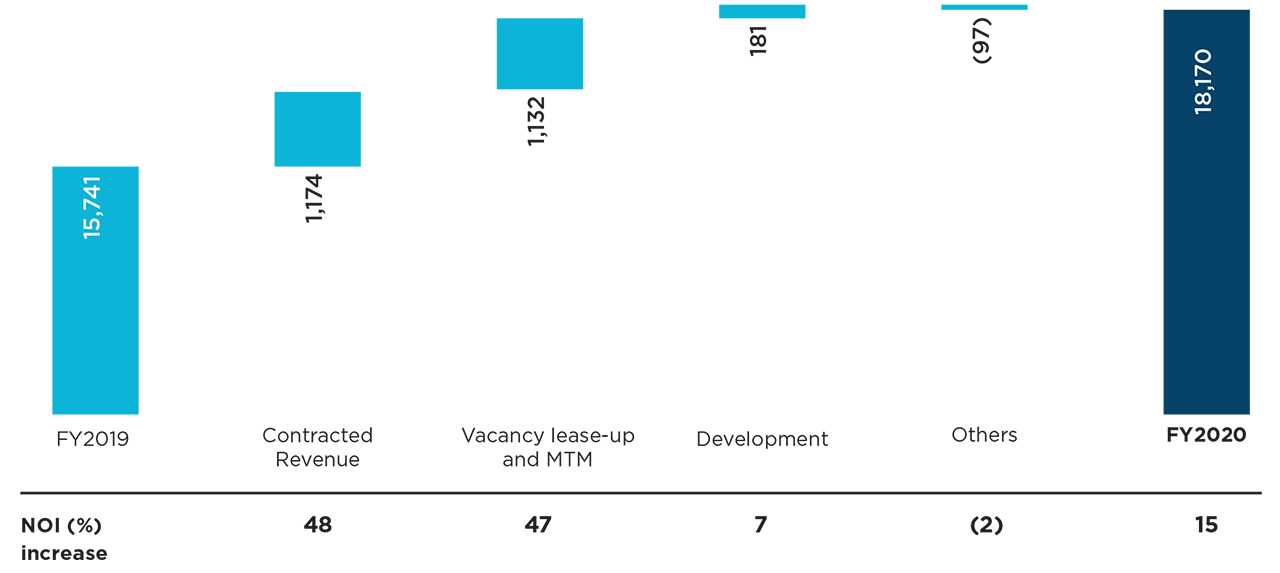

Net operating income (NOI)

(` in million)

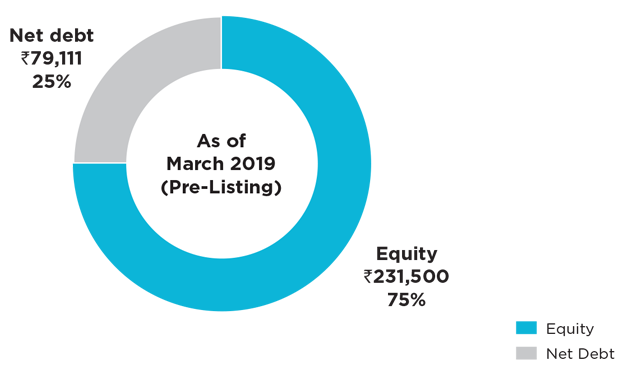

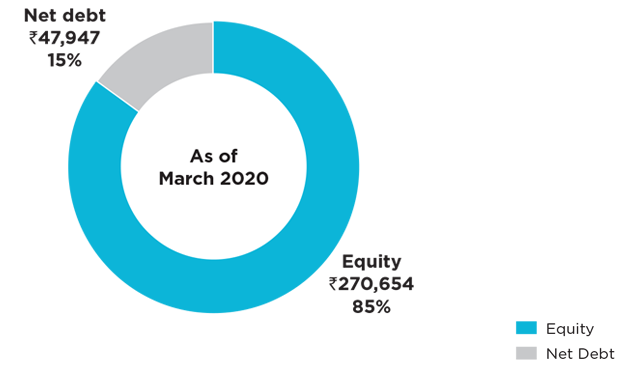

Strong balance sheet

Net debt to capitalisation1

(` in million)

Net debt to TEV2

(` in million)

Net asset value

Particulars (` mn) 31-Mar-20 Gross Asset Value (GAV)3,4 329,746 Add: Other Assets 71,608 Less: Other Liabilities (54,793) Less: Gross Debt (57,461) Net Asset Value (NAV) 289,100 Number of Units 771,665,343 NAV per Unit (`) 374.64Leverage metrics

Particulars (` mn) 31-Mar-20 Net Debt to TEV 15% Net Debt to EBITDA 2.7x Interest Coverage Ratio – excluding capitalised interest 5.1x – including capitalised interest 4.0xProactive capital management

`9,514 million

Existing cash balance5

1.3%

Debt maturity in next 2 years

`3,997 million

Undrawn committed facilities

`114 billion

Available debt headroom

Principal maturity schedule

(` in million)

- FY2021

- FY2022

- FY2023

- FY2024

- FY2025+

Notes:

1 Computed on listing price of `300/unit and excludes `47,500 mn cash raised through Initial Public Offering

2 Closing price on National Stock Exchange as at March 31, 2020

3 GAV per Mar’20 valuation by independent valuer. Valuation exercise undertaken semi-annually

4 Given Embassy REIT owns 50% economic interest in GLSP, GAV includes fair value of equity investment in GLSP basis equity valuation method

5 Includes treasury balances, fixed deposits etc., net of 4Q FY2020 distribution of `5,317 mn