Our portfolio

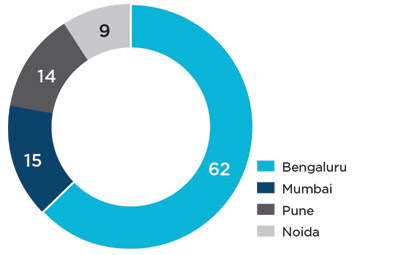

Market value by geography (%)

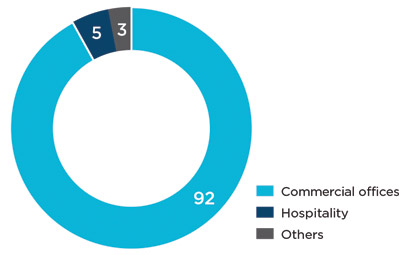

Market value by asset type (%)

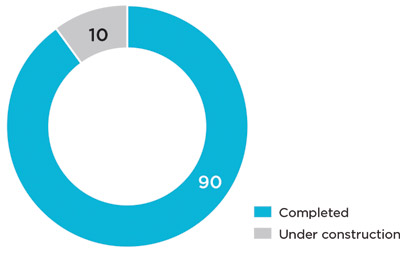

Market value by construction status (%)

We own, operate and invest in rent or income-generating office real estate and related assets in India in accordance with the REIT regulations.

Investment objectives

We invest in high-quality assets with the objective of maximising NAV growth and paying distributions to Unitholders.

80%

Minimum investment by value in completed and income-producing assets

90%

Minimum NDCF payout to Unitholders

49%

Upper limit on debt by asset value